6 Brilliant Budgeting Apps For College Students

May 20, 2024

The fact that college expenses may be difficult to keep an eye on is undeniable, although not unmanageable. It is important to plan your personal finances to prevent the occurrence of unexpected expenditures and long-term debts. It also helps to plan and be able to spend money wisely in the future.

An application for budget planning can make it easier for you to take care of your finances. When you have a budget app on your side, you can not only track your expenses but also make a budget and set financial targets. Here’s a compilation of great collegian-friendly budgeting apps.

Chip

Do you often overspend your money to the point that it gets finished before the semester is over and get stranded when you have urgent things to sort like paying for a well-written essay from sites like https://payforessay.net/? If so, Chip can help you to conveniently control your funds so you can avoid overspending and save more. The app is designed to help you monitor and control your expenses. It uses a system of “chips” to represent different categories of spending like transportation, entertainment, and groceries, etc. You can allocate a certain amount of chips to each category and track the monthly progress.

Chip also features an AI tool called autosave, which evaluates your spending habits and bank balance. It also aids in estimating the amount you can invest or save. The app also has additional features like payment integration, goal setting, and spending insights. Another outstanding feature of this tool for budgeting is it offers two usage arrangements: the basic plan and the ChipX plan. You use what you feel will help meet your budgeting aims.

Personal Capital

If you are aspiring to save big or invest while still in school, Personal Capital is the right helper for that. This money tool enables you to check your investment on the dashboard and determine your net worth using an asset allocation feature. It allows you to set your financial aspirations, such as clearing a debt or saving for an automobile purchase and making a budget that keeps you on course. Moreover, it allows setting of reminders for pending and upcoming bills. On top of that, you can request a report on your spending habits.

Mint

Mint is a free money app that eases budget creation. You can connect your bank cards and account to automatically categorize and monitor your spending. It’s possible to set up different categories like meal expenses, college books, transport, or other materials and place limits on each classification based on how much you can use. After you connect this money tool with your bank accounts, it monitors your spending by recording it in a spreadsheet, providing a satisfactory way to keep an eye on your funds. It helps you determine where you can make adjustments to your budget. If every time you want to hire a paper writer such as those described in PayforEssay review but find your pockets empty and wonder where the money has gone, Mint can assist you in making adjustments to your spending to avoid such cases.

Goodbudget

If you want to get ahead financially, Goodbudget is a suitable tool to help with that. It has web and mobile versions for watching your payments, repayment of debts, and savings. Its function is based on a traditional envelope concept and can help you watch your monthly expenditures. When using this money tool, you have to allocate each dollar to its purpose. How? You place your earnings in different envelopes. The envelopes have categories like groceries, children’s expenses, debt payments, and so on. Then, after spending the income, you remove it from the envelope. Ensure you update your envelope balances each time you move money. The application also offers graphs that are easy to interpret to help understand how you spend. The tool has two arrangements for usage: a free plan and a paid version.

PocketGuard

PocketGuard aids to manage your funds at an unrefined level. It enables you to make a budget and a plan for repaying debts. Besides, it offers lessons on money concepts and spending insights. This tool is fit for individuals who have overspending habits and want to take financial control. It helps you put your monetary activities in one place. You can link it to several bank accounts and monitor all your monetary activities on one dashboard. This money app automatically finds your earnings and recurring bills once you connect them with your bank accounts. You can use this budgeting tool to make, evaluate, and amend your budget. If you like using spreadsheets for budgeting purposes, you can use the paid version to export transactions to Microsoft Excel. Another brilliant feature of this money tool is the capability to track your unused subscription services to ensure you aren’t paying for subscriptions that are not in use.

EveryDollar

EveryDollar is another brilliant money tool for collegians. It allows you to set your aims for saving and make a customizable budget. It’s a good choice if you are searching for back-to-basics and simple budgeting software. Building a budget helps you produce a spending plan so that you can track and know where your money goes. This tool for budgeting helps you account for each dollar in your earnings. It has 8 categories, but you can also create custom categories.

The functioning of this app is based on the envelope approach of budgeting, which involves dividing your funds into various groups to monitor your spending in each category. With this money app, you can easily categorize and record your expenses and set spending limits. You also receive alerts when you exceed your budget. The app has two modes of usage: free and paid plans.

Closing Remarks

Budgeting should be interesting and not boring as many perceive. Budgeting in college is useful as it can help you be your financial manager in the future. You don’t have to be broke just because you are in college. Learning the basics of money management and beginning as early as now to practice budgeting can help you avoid a financial crisis. Take control of your budgeting by trying the apps mentioned above and make a difference in your financial life.

Dogs Are Forced To Wear The Things They Steal — And It’s Hilarious

Dogs Are Forced To Wear The Things They Steal — And It’s Hilarious

Lost For 65 Days In The Freezing Cold, This Brave Senior Dog Survived Against The Odds

Lost For 65 Days In The Freezing Cold, This Brave Senior Dog Survived Against The Odds

He Says His Sister's Dog Hates Him — And The Pictures Don't Lie

He Says His Sister's Dog Hates Him — And The Pictures Don't Lie

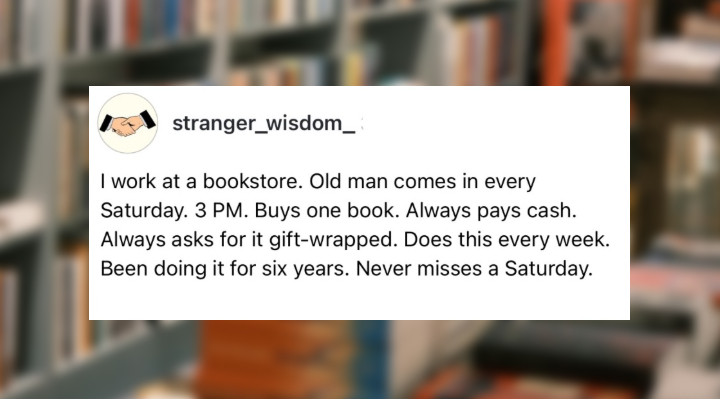

An Old Man Kept Visiting A Bookstore Every Saturday—The Reason Has People In Tears

An Old Man Kept Visiting A Bookstore Every Saturday—The Reason Has People In Tears

Someone Put A Pinecone In Their Shower… And People Are Fascinated By What Happened

Someone Put A Pinecone In Their Shower… And People Are Fascinated By What Happened

He Showed Up Looking Like A Hairless Cat… Months Later, No One Can Believe The Transformation

He Showed Up Looking Like A Hairless Cat… Months Later, No One Can Believe The Transformation

This Apology During A Volleyball Game Is The Best Apology You Will See Today

This Apology During A Volleyball Game Is The Best Apology You Will See Today

Strangers Teach A Young Girl To Jump Rope And Stop Her From Giving Up

Strangers Teach A Young Girl To Jump Rope And Stop Her From Giving Up

This Family Built A Colorful Igloo And It’s Magical

This Family Built A Colorful Igloo And It’s Magical

Mom Filming Newborn Catches A Magical Surprise Visitor

Mom Filming Newborn Catches A Magical Surprise Visitor

Grandma Has Dementia — See What Happens When Her Husband Sings At A Wedding

Grandma Has Dementia — See What Happens When Her Husband Sings At A Wedding