Pro Tips for Creating an Effective Trading Strategy

September 12, 2022

People who develop their own trading strategies and systems know how important it is to revise, rework, and improve on a regular basis. Nothing is ever set in stone. But aside from that bedrock principle, how can serious traders develop a technique in the first place? How much technical skill and market knowledge go into assembling a rules-based approach that can serve as the basis for the daily buying and selling of various assets?

What are the most effective and efficient ways to test and evaluate the systems you come up with? After acquiring the rudimentary skills associated with building trading techniques, it's imperative to study what more experienced investors are doing, read extensively on the topic, use demo accounts to do dry runs, check initial results, know the limitations of back testing, and much more. Here are pertinent details for anyone who wants to get the most out of the programs they create.

Learn the Basics

Step one consists of acquiring the ground-level skills for assembling a system that serves your unique needs. That means learning how to use templates, studying other traders' methods, reading pertinent books on the topic, and experimenting with a few very rudimentary approaches within demo accounts.

Test Your Theories

The top practitioners are always testing, tweaking, adapting, and improving their trade strategies as time passes, and they gain more experience. An excellent place to begin is with the question what is paper trading and then proceed from there. Demo accounts can be a great help for people of all experience levels. Paper trading is a term that refers to using fictitious accounts and fake money to practice all the techniques that interest you. Some take part in this exercise for several weeks before putting any of their own capital at risk. In addition to those who are new to the markets, experienced traders use demo transactions to test their theories and get a feel for how they'll work out in actual practice.

Tweak to Optimize Results

After a week or so of doing live transactions with your own application, do a thorough review and examine the results. Note the areas in which you think improvements could be made. Adjust parameters as necessary, remove bugs, and generally tweak any components and details that can use upgrading. This process is a critical part of the process and should not be skipped.

Do a One-Month Trial

After the initial tweaks, which are actually the first round of fixes, put your theories to a longer test. One entire month of live action can reveal a lot about the quality of the program. This is the phase of the process where you make final adjustments and corrections. Of course, even after everything is perfect, it's important to be open to more changes based on how the overall market behaves. Note that some trading techniques do better in bear markets, while others shine in rising ones.

The Pros and Cons of Back Testing

If your platform allows for back testing, consider using several years of historical data to see how your method would have performed in prior years. The advantages of this approach are obvious: it delivers solid data about whether your ideas would have produced profits in recent years, but it does come with limitations. However, back testing is not perfect, so don't assume that positive back testing results guarantee anything about future performance. There are strategies that do very well under back testing conditions but don't live up to their promise in current conditions. Likewise, poor results don't mean your system will perform badly in the future. The value of back testing is in its ability to serve as yet another screening device to test out the overall viability of a trading approach.

Why Not Copy Someone Else?

There are dozens of online brokerage websites that let account holders sign up for copy trading. Every day, millions who have no time to develop their own methods turn to more experienced investors. Signing up to copy someone else can save you time, but there are distinct disadvantages as well. Many lead traders charge a percentage or flat rate fee for their services. Additionally, copying doesn't teach you anything. If you're content to blindly follow others and perhaps make, or not make, a decent profit doing so, then perhaps copy trading is for you. Otherwise, if you are a more creative, hands-on type of person, then it's highly likely you'll be happier if you create a technique from scratch, one for which you pay no fees and which you can amend and improve to your heart's content.

Dogs Are Forced To Wear The Things They Steal — And It’s Hilarious

Dogs Are Forced To Wear The Things They Steal — And It’s Hilarious

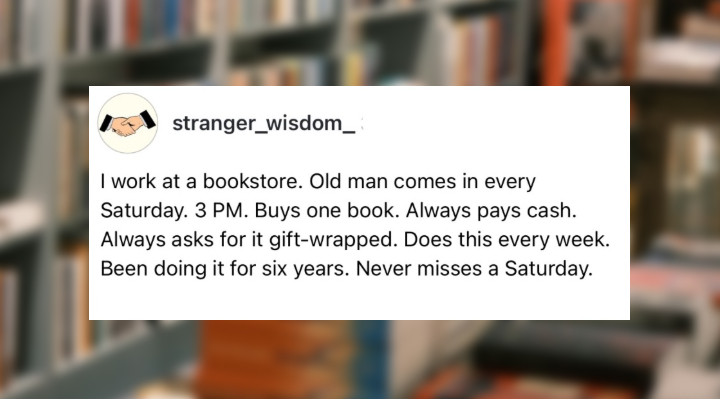

An Old Man Kept Visiting A Bookstore Every Saturday—The Reason Has People In Tears

An Old Man Kept Visiting A Bookstore Every Saturday—The Reason Has People In Tears

He Says His Sister's Dog Hates Him — And The Pictures Don't Lie

He Says His Sister's Dog Hates Him — And The Pictures Don't Lie

Someone Put A Pinecone In Their Shower… And People Are Fascinated By What Happened

Someone Put A Pinecone In Their Shower… And People Are Fascinated By What Happened

He Showed Up Looking Like A Hairless Cat… Months Later, No One Can Believe The Transformation

He Showed Up Looking Like A Hairless Cat… Months Later, No One Can Believe The Transformation

Bill Murray Says This Painting 'Saved His Life' — And It Still Inspires Visitors Today

Bill Murray Says This Painting 'Saved His Life' — And It Still Inspires Visitors Today

This Apology During A Volleyball Game Is The Best Apology You Will See Today

This Apology During A Volleyball Game Is The Best Apology You Will See Today

Strangers Teach A Young Girl To Jump Rope And Stop Her From Giving Up

Strangers Teach A Young Girl To Jump Rope And Stop Her From Giving Up

Mom Filming Newborn Catches A Magical Surprise Visitor

Mom Filming Newborn Catches A Magical Surprise Visitor

Grandma Has Dementia — See What Happens When Her Husband Sings At A Wedding

Grandma Has Dementia — See What Happens When Her Husband Sings At A Wedding

Little Girl Asks Nursing Home Residents One Question —Then Starts Granting Their Wishes

Little Girl Asks Nursing Home Residents One Question —Then Starts Granting Their Wishes