Live Your Best Life By Living Debt-Free

February 5, 2021

Many people have the unfortunate experience of having an income that is not keeping up with the cost of living. While just having a job can feel like an accomplishment in a tough economy, not having the money you need to cover expenses is stressful and makes it difficult to enjoy even small pleasures. It is hard to look around and see others taking great vacations and driving the latest model cars, but if you can redefine what it means to be successful, you can enjoy the things you crave as well.

Getting your finances in order allows you to direct money towards trips, buying a home, or follow another interest. When the time comes, you can enjoy yourself, knowing that you are not putting yourself in a precarious financial situation by doing what you enjoy.

Am I Financially Secure?

If you find you need to put everyday expenses on credit cards, you know you are in over your head. The need to live off your credit card as it gets close to payday, even if you pay your card off in full each month, is an early warning sign that your financial health is not where it needs to be. For those with existing credit card debt, the challenge of paying off that expense while still meeting your day-to-day costs can be even more challenging. You may find yourself in a cycle of running short each month, so any progress you make on paying down your debt is lost when you need to use your cards to cover you until your next paycheck.

Break the Cycle

You need to change your approach to debt if you hope to pay it off. Instead of doing the same thing each month, revamp your budget and spending habits so you can make real change. While cutting expenses in some areas can be tough, there are many changes you can make that are painless and effective. If you have student loan debt, look at your refinancing options. When you refinance, your existing balance is paid off, and you take out a new loan through a private lender. This simple action, which you can complete online in minutes, can free up hundreds each month. You can use this money to better balance your budget or tackle existing debt.

Reward Yourself

Life is all about balance. If you throw yourself into aggressively paying off your debt, you may find that after a certain period you end up revolting. Slashing spending to the point where there is no room for the occasional treat is a recipe for failure. Instead, make room in your budget for the occasional treat. One way to treat yourself without adding too much to your budget is by taking up an inexpensive hobby. Crafting, hiking, or gardening are all hobbies you can do inexpensively. A hobby that allows you to express your creativity reduces stress and gives you something to look forward to, which makes it easier to stay on budget. Without these things, you are more likely to make impulse purchases because you are bored, tired, or unhappy with your job.

Give Back

When your budget is tight, you may not feel comfortable donating money, but contributing to charities that you believe in provides many emotional benefits. If you don't have extra money, consider donating your time. Even one afternoon a month is enough to feel like you are contributing to a cause you believe in and are a part of something bigger than yourself.

Dogs Are Forced To Wear The Things They Steal — And It’s Hilarious

Dogs Are Forced To Wear The Things They Steal — And It’s Hilarious

Meet Nazgul: The Dog Who Crashed An Olympic Ski Race And Nearly Won

Meet Nazgul: The Dog Who Crashed An Olympic Ski Race And Nearly Won

People Are Submitting Photos of Their Cats’ ‘Jobs’— And We Can’t Stop Laughing

People Are Submitting Photos of Their Cats’ ‘Jobs’— And We Can’t Stop Laughing

A Childhood Bond Reunited: Firefighter Saves The Horse That Taught Him To Ride

A Childhood Bond Reunited: Firefighter Saves The Horse That Taught Him To Ride

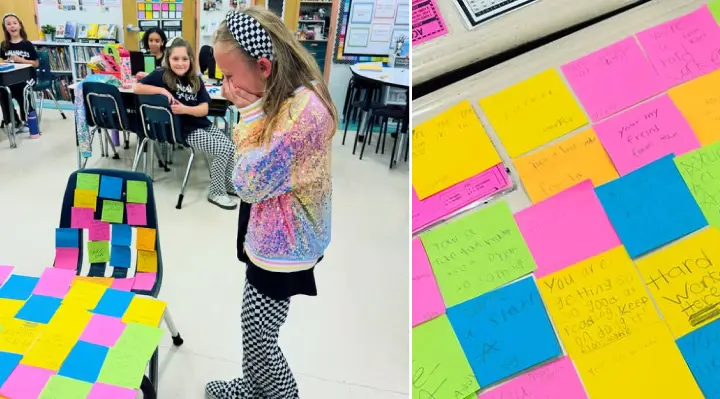

She Was Feeling Low On Confidence, So Her Classmates Covered Her Desk In Sticky Notes

She Was Feeling Low On Confidence, So Her Classmates Covered Her Desk In Sticky Notes

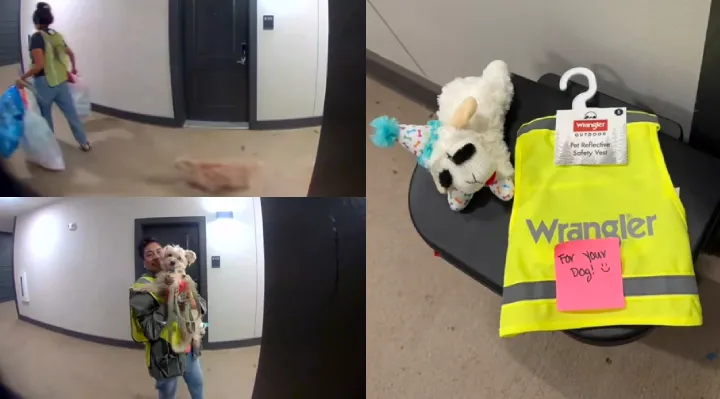

She Collects Trash 5 Days A Week With Her Dog — So A Resident Gifted Her Dog A Matching Vest

She Collects Trash 5 Days A Week With Her Dog — So A Resident Gifted Her Dog A Matching Vest

Mom Was About To Miss Her Flight, So A Stranger Picked Up Her Kid And Ran With Her

Mom Was About To Miss Her Flight, So A Stranger Picked Up Her Kid And Ran With Her

He Ordered A Doctor Bag — But The Size Has Him Laughing Uncontrollably

He Ordered A Doctor Bag — But The Size Has Him Laughing Uncontrollably

Woman Stunned By Valuation Of Rare Māori Jade Hei-Tiki Found In Her Garden

Woman Stunned By Valuation Of Rare Māori Jade Hei-Tiki Found In Her Garden

She Gave Her Dad The One Thing He’d Been Searching For His Whole Life

She Gave Her Dad The One Thing He’d Been Searching For His Whole Life

He Went Back To Pay The Man Who Helped Him — But That’s Not What Happened

He Went Back To Pay The Man Who Helped Him — But That’s Not What Happened